Tuesday, January 10, 2012

Inside bar after BO bar

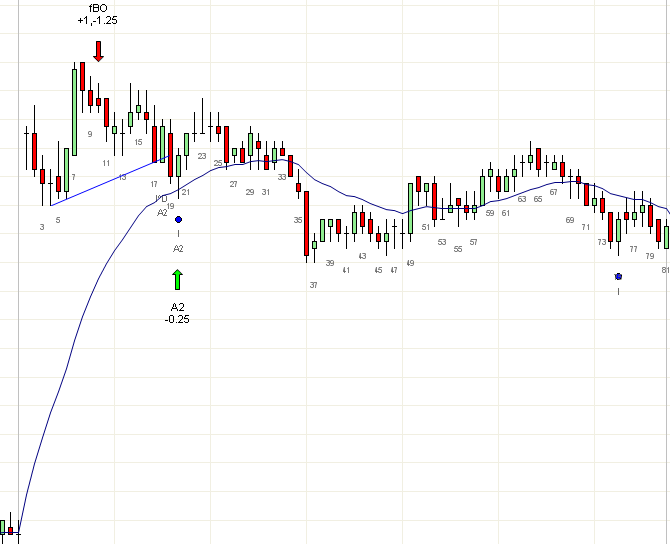

An inside bar right after a BO bar (b8, b37) often signals a failed breakout. A failed breakout does not automatically imply a trend move will setup, but since failures generally have at least two legs, a strong signal near a support such as b20 reversal bar at ema is an acceptable signal.

However, when the range is small, the market will often give a fBO or BP at the other end of the range as we saw at b37. This time it resulted in a complex pullback all the way to b67. One approach to maximizing fBO trades is to exit part on a strong push such as b17,b19 or b49 and exit the balance on any strong counter-trend signal such as b20 or b65.

Labels:

fBO

Subscribe to:

Post Comments (Atom)

Would you consider bar 13 as a 1pb setup? If not what would be your reasons for avoid the trade.

ReplyDeleteThanks

I posted this a few days ago but perhaps too late for anyone to notice or comment.

ReplyDeleteI did visual inspection of 276 5 minute charts of the ES (December 10, 2010 through 1/6/2012 to see what happens if one trades a breakout of the first bar (b1).

I divided the trades into those with ≥ 2 point gap and those < 2 point gap—an arbitrary number. I did not track the direction of the gap. If b1 was a doji, it was not included; there were 8.

Loss ≥1&<2pts. ≥2&<3pts. ≥3pts. Total

Gap 46 30 28 91 195

No Gap 24 25 7 17 73

b1=doji - - - - 8

Total 70 55 35 108 276

A few stat’s:

If the day opens with a gap—

148/195 are profitable for at least 1.0 point. (79%)

91/195 are profitable for at least 3 points. (47%)

If the day opens without a gap—

49/73 are profitable for at least 1.0 point. (67%)

17/73 are profitable for at least 3 points. (23%)

Overall, ignoring gaps—

197/268 are profitable for at least 1.0 point. (73%)

I have not yet dealt with the stop loss question simply assuming the normal PA approach of exiting a losing trade at the H/L ± 1 tick of b1.

If one uses Cad’s approach of scalping the first portion of trade and then letting the remainder swing with a breakeven stop loss and one’s choice of trailing stop.

I noticed on many of the failed trades b2 gave a nice fBO signal. I didn't explicitly count them however.

Omar, as I've posted before if there is a reversal setup you should not take the first resumption attempt as a 1PB, especially one that is a weak bar such as a doji.

ReplyDelete