Monday, September 3, 2012

The hard road to consistency IX -- The need to re-learn lessons over and over

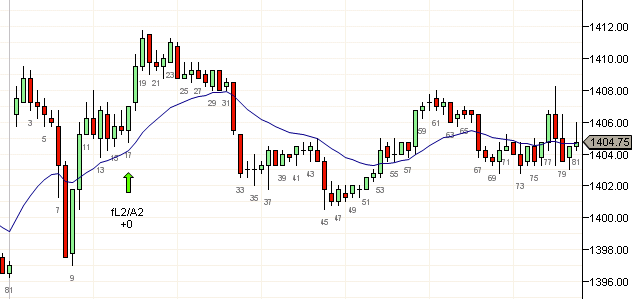

A trader should be expected to constantly having to learn and re-learn lessons and this is just part of learning to trade. Some of this is due to being emotionally reactive. A trader who sees a huge bar like b8 may be tempted to sell below it and is likely to be stopped out. Similarly, a trader may short a bull trend all the way to the top and blow up an account.

The first step is to understand what made you fail. Did you enter on fear of being left out instead of waiting for a setup? Are you deficient in some price action principles? (shorting all the way to the top = does not understand trends can go on indefinitely). Are your stops too tight? Are your targets too lofty? Do you enter too early? Do you love to pick tops and bottoms? Do you enter before a signal bar closes only to find that the good looking bull bar 30 seconds before bar close is now a bear bar? Do you enter on limit banking on your ability to predict reversals to the tick? Do you misread overlaps and chop as patterns?

Whatever your errors may be, you need to first identify them. The next step is to figure out the right way to trade those situations. Ignoring actual reversals and taking the 1st pullback after the successful reversal alone eliminates over half the errors above. Using proper trade management eliminates most of the others. If you can get here, you should be breakeven to slightly profitable on most days. But to get here, you need to practice over and over and only sustained effort can break your bad habits.

Days where price action exposes a large gap in your experience (counter-trend trading on trend days) are likely to still create large losing days and therefore, you should switch to SIM to collect data on these days. Identifying market structure responsible for huge losses and acting on them is a much harder task, but the fact that you switched to SIM after two losing trades enables you to stay in the game and figure out ways to identify and trade such exceptional days.

Even so, there would be rare days such as the flash-crash that could still give you some trouble. But you would be far more confident in your trading and welcome the opportunity to learn from exceptional events.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment